- Equifax breach settlement status plus#

- Equifax breach settlement status professional#

- Equifax breach settlement status download#

- Equifax breach settlement status free#

To keep track of expenses associated with identity theft for future claims, Lacey suggests using the ITRC's ID Theft Help App.

Equifax breach settlement status professional#

Professional services from lawyers and accountants fall into this category, too.Īs for identity theft costs, the FTC will accept claims for any unreimbursed losses following the breach's start in May 2017, the commission notes, because it's difficult to correlate a loss with a given data breach. Out-of-pocket expenses can include money you spent on credit freezes or credit monitoring, postage, faxes, mileage, and telephone charges. Step 6: Under Cash Payment, you can request reimbursement for up to $20,000 in losses, but you will need to document those expenses, except for any credit monitoring by Equifax that you paid for. "And, of course, include the time you spent filling out the claim," Lacey adds. If you had to make a trip to the bank or another financial institution, that travel time counts, too. That may include not only time spent talking to a representative from a bank or a credit card company, but also time spent waiting on hold. The form asks you to supply the total amount of time spent on each task, the month and year, and a brief description of the task. For time beyond that, you must include supporting documents showing that your personal data was misused. The first 10 hours require only a description of the time spent. Step 5: In Section 2, you can request reimbursement for up to $500 (20 hours at $25 per hour) for time spent managing accounts affected by the breach. "If you can use other services, take the $125," says Lacey.įor consumers skeptical about accepting the credit monitoring, Lacey explains, "it's not Equifax doing the work it's their competitors doing it on their behalf." There's no requirement to submit a receipt.

Equifax breach settlement status free#

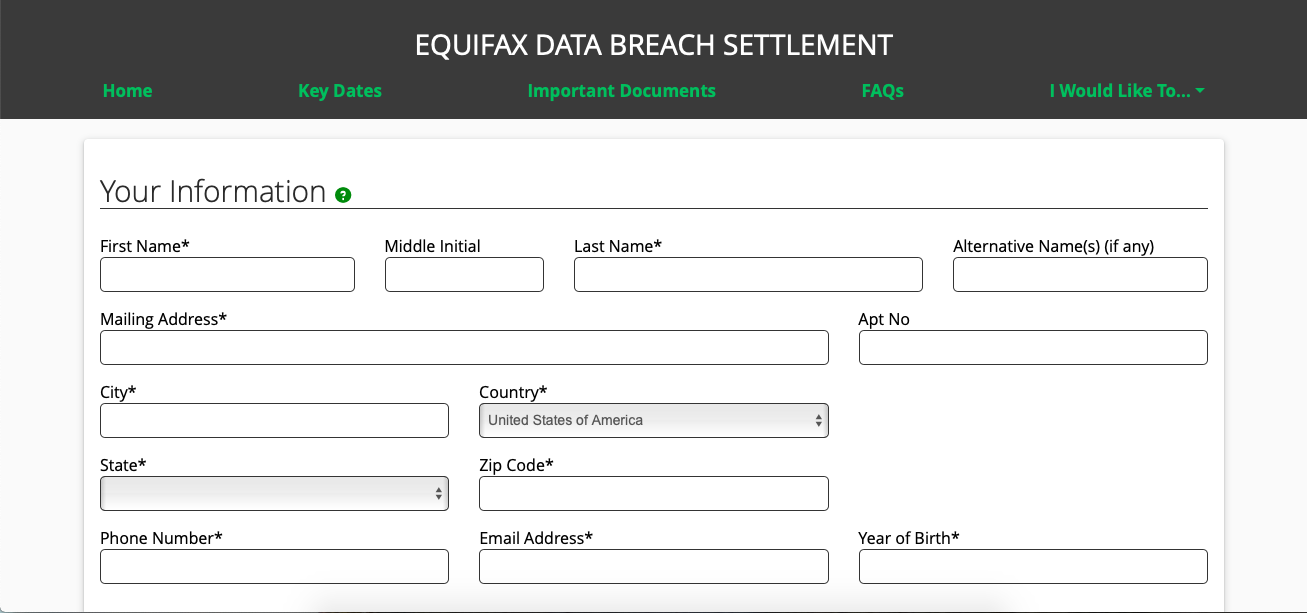

It can be free credit monitoring through an employer or a financial institution. To get the cash, you must certify that you have credit monitoring and will keep it for six months. Step 4: In Section 1, you get the option of free credit monitoring from Equifax, Experian, and Transunion or a cash payment of $125. Remember that "Alternative Names" is a good place to include your maiden name. Step 3: Next, you'll see your options for reimbursement and fields where you'll fill out your personal information. Here's the return address:Įquifax Data Breach Settlement Administrator For security reasons, claims for minors must be sent by mail.

Equifax breach settlement status download#

Filing online is the most convenient, but you can also download a form or have one mailed to you. Step 2: On the next page, you'll find your options for filing. "Kids Social Security numbers aren't golden-they're like platinum-for identity thieves," she says. Lacey advises parents to see if their children were impacted, as well.

If the answer is yes, click on File a Claim Today toward the top of the page. After entering your last name and the last six digits of your Social Security number, you'll instantly get an answer about whether your data was exposed and you're eligible to make a claim.

Then scroll down to "Find Out if Your Information Was Impacted" and click on that link. Step 1: Use this link to access the claim process. Here's a step-by-step run-through of the online application process.

Equifax breach settlement status plus#

If you simply spent time researching your options and locking down your accounts, you can make a less detailed claim that will provide you with a little cash, plus free credit card monitoring and identity theft restoration services. If you were the victim of identity theft and it cost you a significant amount of money, it makes sense to gather the receipts and other supporting documents required for a claim that approaches the $20,000 individual limit. The best approach to the claim process depends on the extent of your losses. She notes that consumers can claim up to $375 ($250 for time spent and $125 for current credit monitoring) without providing any documentation. "People feel they have to have all this information, but that's not necessarily the case," says Charity Lacey, vice president of communications for the Identity Theft Resource Center, a California-based consumer organization. In a Monday press conference, the FTC announced that consumers would be able to report some credit monitoring expenses and the time they spent resolving issues raised by the breach without having to submit receipts or other records.

0 kommentar(er)

0 kommentar(er)